The Social Security System in the Philippines has announced an increase in the 2025 SSS monthly contributions for Filipino members. This increase is intended for business employers and employees, household workers or kasambahay, voluntary and self-employed members, and Overseas Filipino Workers (OFWs).

Starting January 2025, the Social Security System (SSS) will implement a revised Contribution Table under the Social Security Act of 2018. These updates aim to enhance the system’s long-term stability and improve benefits for members. Key adjustments include a higher contribution rate, expanded Monthly Salary Credit (MSC) brackets, and updated allocation rules.

The new contribution rate will be set at 15% of the MSC, with the minimum MSC increased to ₱5,000 and the maximum set at ₱35,000. These changes are designed to boost support for members in retirement, disability, and other social security programs. In case you are wondering what these changes are and its impact on you, below is a comprehensive guide to help you understand the new pension scheme as well as the SSS table chart for different member categories.

Contents

- Key Features of the New 2025 SSS Pension Increase

- New SSS Table Adjustments on Monthly Salary Credit (MSC)

- SSS Contribution Schedule Table 2025 for Business Employers and Employees

- SSS Contribution Schedule Table 2025 for Household Employers and Kasambahay

- SSS Contribution Schedule Table 2025 for Self Employed Members

- SSS Contribution Schedule Table 2025 for Voluntary and Non Working Spouse Members

- SSS Contribution Schedule Table 2025 for Overseas Filipino Workers OFWs

- Eligibility Requirements for the New Pension Scheme

- Enhanced Benefits of the 2025 Pension Scheme

- Payment Schedule for 2025

- Application Process for the Pension Increase

- Video: SSS Table 2025 Rates

- SSS PDF 2025 Increase Download File

- Closing Remarks

Key Features of the New 2025 SSS Pension Increase

The updated scheme introduces several noteworthy features, ensuring that benefits align with the growing cost of living while maintaining the sustainability of the program.

Substantial Pension Increase

One of the highlights of the new SSS pension scheme is the 14.5% to 15% increase in monthly pensions. This translates to an additional PHP 1,000 to PHP 2,000 for beneficiaries, offering improved financial stability for retirees and their families. The adjustment ensures that pensioners can better cope with rising living costs while enjoying a better quality of life.

Revised Contribution Rates

Starting in 2025, contribution rates have risen to 15% of the monthly salary credit. This adjustment reflects a long-term strategy to protect the SSS fund’s sustainability while increasing future benefits for contributors. Although this hike requires higher contributions, it promises better returns during retirement.

Phased Rollout

To minimize disruptions, all updates are being implemented through a phased process. This strategic approach allows contributors and beneficiaries to adapt seamlessly to the new system while maintaining operational efficiency within the SSS framework.

New SSS Table Adjustments on Monthly Salary Credit (MSC)

A crucial aspect of the SSS updates is the revised contribution table. This table outlines the mandatory contributions across different income brackets. The changes address both salaried employees and self-employed contributors, ensuring inclusivity across the board:

| Monthly Salary Range | MSC | Employer Contribution | Employee Contribution | EC Program (Employer) | Total Contribution |

|---|---|---|---|---|---|

| ₱5,000 – ₱5,249.99 | ₱5,000 | ₱500.00 | ₱250.00 | ₱10.00 | ₱760.00 |

| ₱9,750 – ₱10,249.99 | ₱10,000 | ₱1,000.00 | ₱500.00 | ₱10.00 | ₱1,510.00 |

| ₱19,750 – ₱20,249.99 | ₱20,000 | ₱2,000.00 | ₱1,000.00 | ₱30.00 | ₱3,030.00 |

| ₱25,750 – ₱26,249.99 | ₱26,000 | ₱2,600.00 | ₱1,300.00 | ₱30.00 | ₱3,930.00 |

| ₱30,750 – ₱31,249.99 | ₱31,000 | ₱3,100.00 | ₱1,550.00 | ₱30.00 | ₱4,680.00 |

| ₱34,750 and above | ₱35,000 | ₱3,000.00 | ₱1,500.00 | ₱30.00 | ₱5,280.00 |

This table ensures a balance between affordability and fund sustainability, offering contributors a clear understanding of their obligations and benefits.

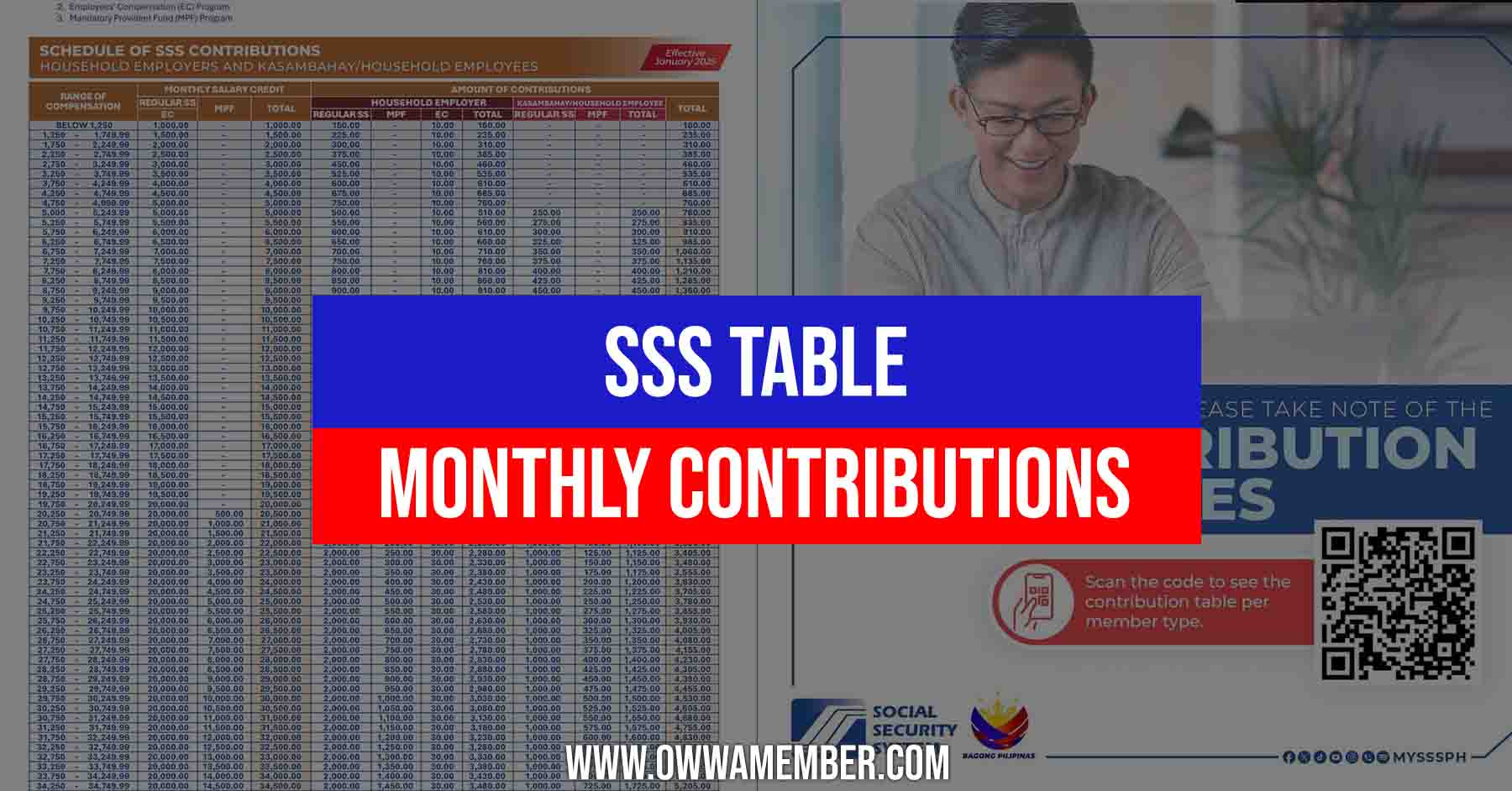

SSS Contribution Schedule Table 2025 for Business Employers and Employees

The 2025 SSS contribution table for business employers and employees ensures a balanced sharing of the social security payments. Employers contribute two-thirds of the total amount, while employees handle the remaining one-third. For instance, at the minimum MSC of ₱5,000, the employer contributes ₱500, and the employee contributes ₱250, totaling ₱750.

At the maximum MSC of ₱35,000, the employer’s share is ₱4,000, and the employee’s share is ₱1,250, resulting in a total contribution of ₱5,250. This fair system guarantees that both employers and employees have shared accountability for future benefits, such as pensions and medical assistance.

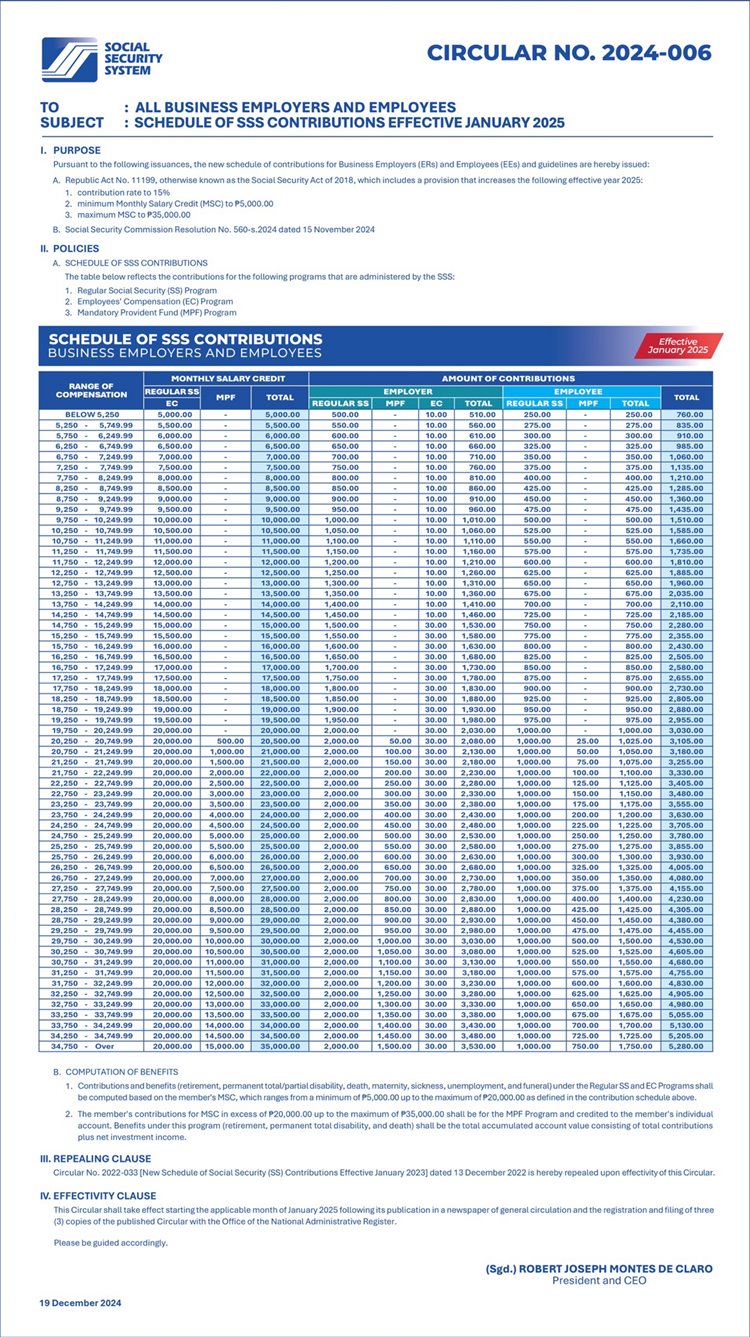

SSS Contribution Schedule Table 2025 for Household Employers and Kasambahay

The SSS contribution schedule for household employers and kasambahay is designed to provide social security coverage for domestic workers while ensuring financial fairness for their employers. Under the 2025 schedule, household employers are required to contribute two-thirds of the total contribution, while kasambahay contribute the remaining one-third.

| MSC | Household Employer Share (PHP) | Employee Share (PHP) | Total Contribution (PHP) |

|---|---|---|---|

| 5,000 | 500 | 250 | 750 |

| 10,000 | 1,000 | 500 | 1,500 |

| 20,000 | 3,000 | 1,000 | 4,000 |

| 35,000 | 4,000 | 1,250 | 5,250 |

For instance, at the minimum MSC of ₱5,000, household employers contribute ₱500 while the kasambahay contributes ₱250, making the total contribution ₱750. This system ensures that household workers receive the same level of social security benefits as other employed individuals in the country.

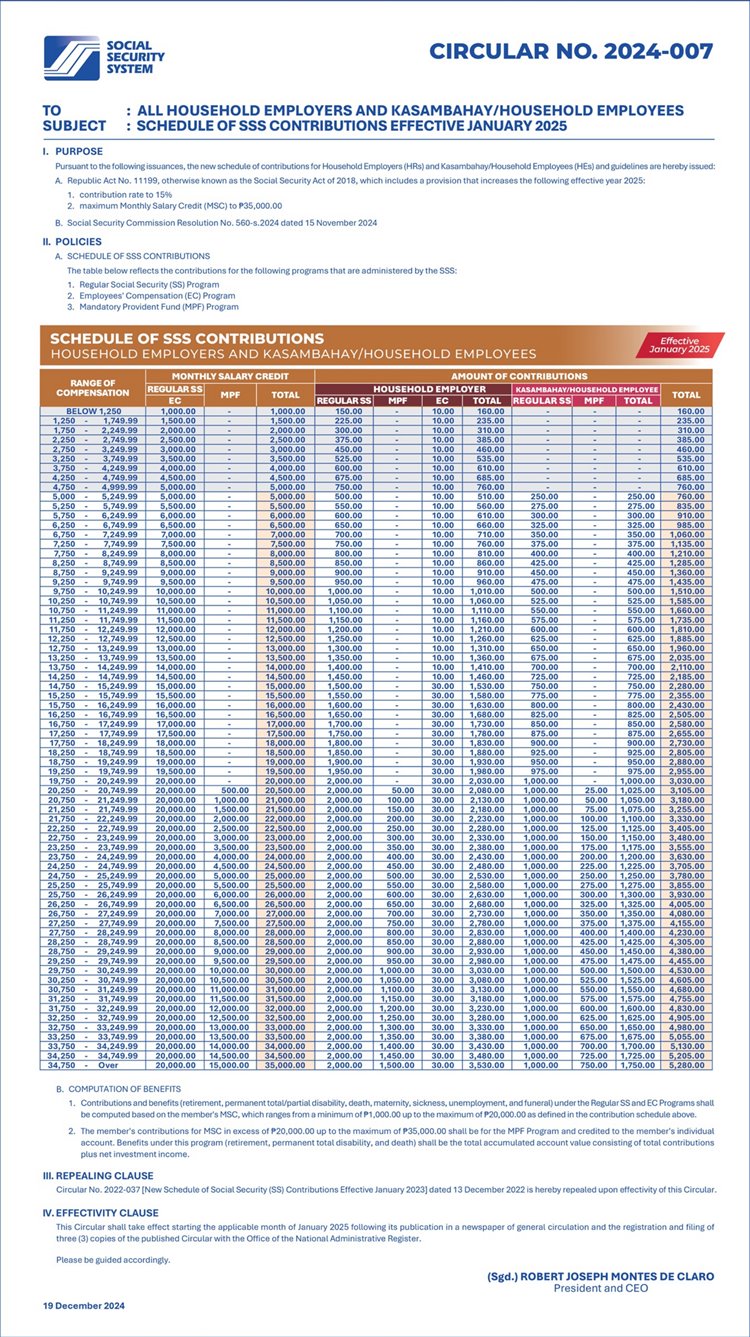

SSS Contribution Schedule Table 2025 for Self Employed Members

The 2025 SSS contribution table for self-employed members emphasizes their responsibility to fully shoulder the 15% contribution rate, as they do not have an employer to share the cost.

| Monthly Salary Range | MSC | SS Contribution | EC Contribution | Total Contribution |

|---|---|---|---|---|

| ₱5,000 – ₱5,249.99 | ₱5,000 | ₱750.00 | ₱10.00 | ₱760.00 |

| ₱15,750 – ₱16,249.99 | ₱16,000 | ₱2,400.00 | ₱30.00 | ₱2,430.00 |

| ₱34,750 and above | ₱35,000 | ₱5,250.00 | ₱30.00 | ₱5,280.00 |

For example, at a monthly MSC of ₱5,000, a self-employed member contributes ₱760, which includes ₱10 for the Employees’ Compensation (EC) program. Self-employed individuals earning more, such as those with a monthly MSC of ₱16,000 and above, contribute ₱2,430 or more. This schedule ensures that self-employed members gain access to robust social benefits without employer support.

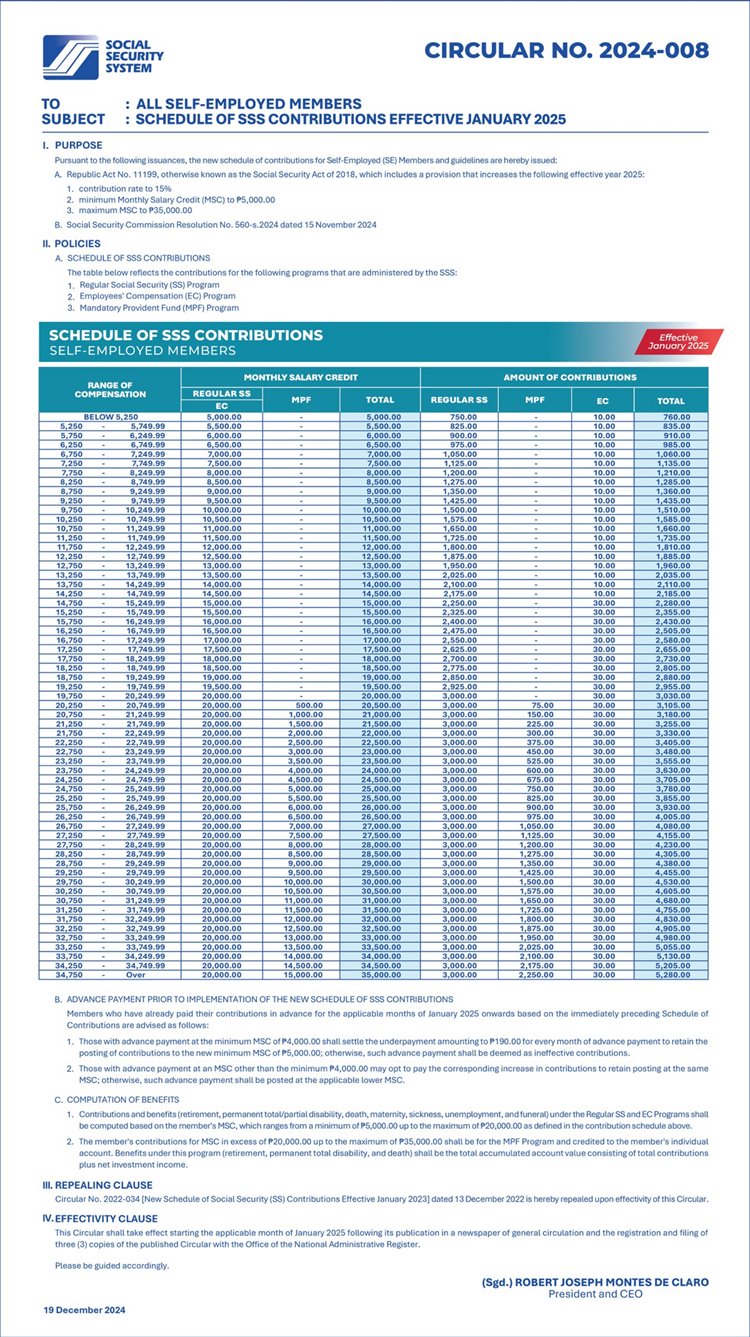

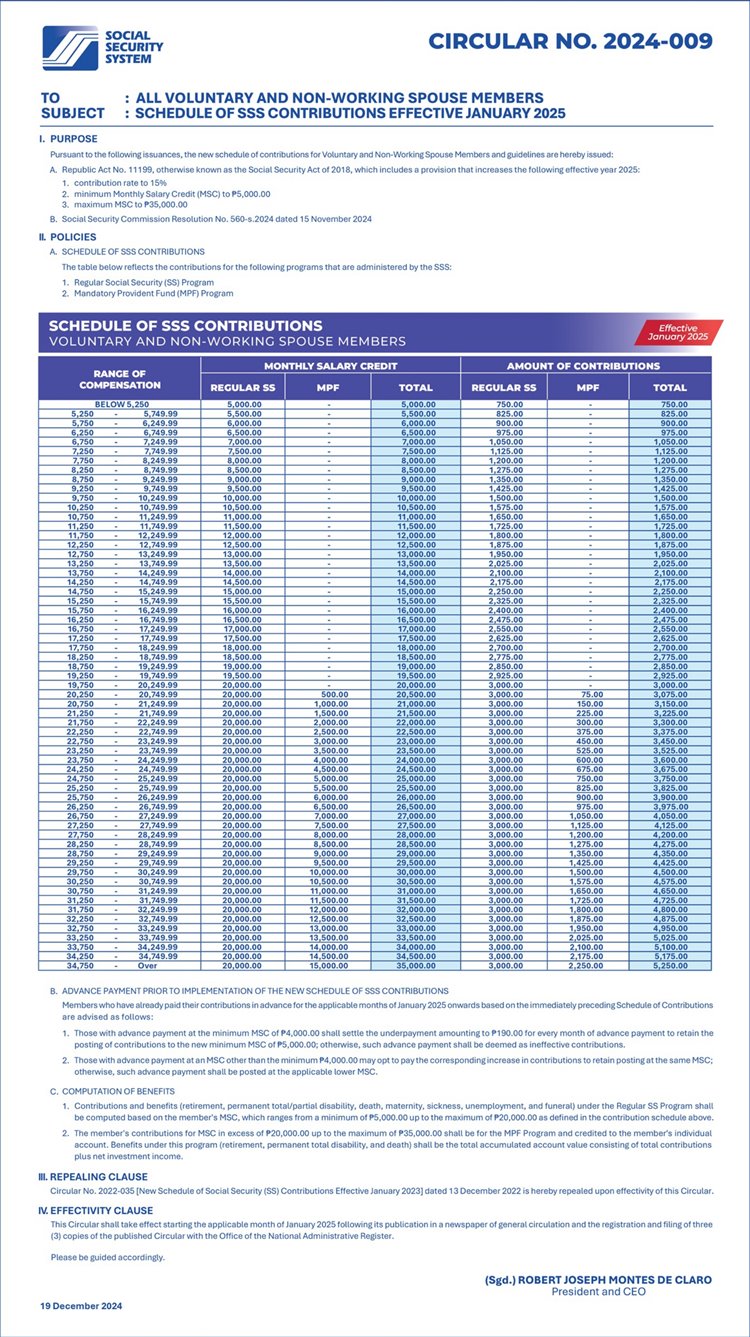

SSS Contribution Schedule Table 2025 for Voluntary and Non Working Spouse Members

Voluntary members and non-working spouses also have specific guidelines for their 2025 SSS contribution schedule, with contributions calculated purely based on their selected MSC. They are exempt from the EC program, unlike employed and self-employed members.

| Monthly Salary Range | MSC | Total Contribution |

|---|---|---|

| ₱5,000 – ₱5,249.99 | ₱5,000 | ₱750.00 |

| ₱15,750 – ₱16,249.99 | ₱16,000 | ₱2,400.00 |

| ₱34,750 and above | ₱35,000 | ₱5,250.00 |

For example, at an MSC of ₱5,000, the total monthly contribution is ₱750, while those choosing the maximum MSC of ₱35,000 contribute ₱5,250 monthly. This structure enables voluntary members and non-working spouses to secure financial stability and social security benefits even without formal employment.

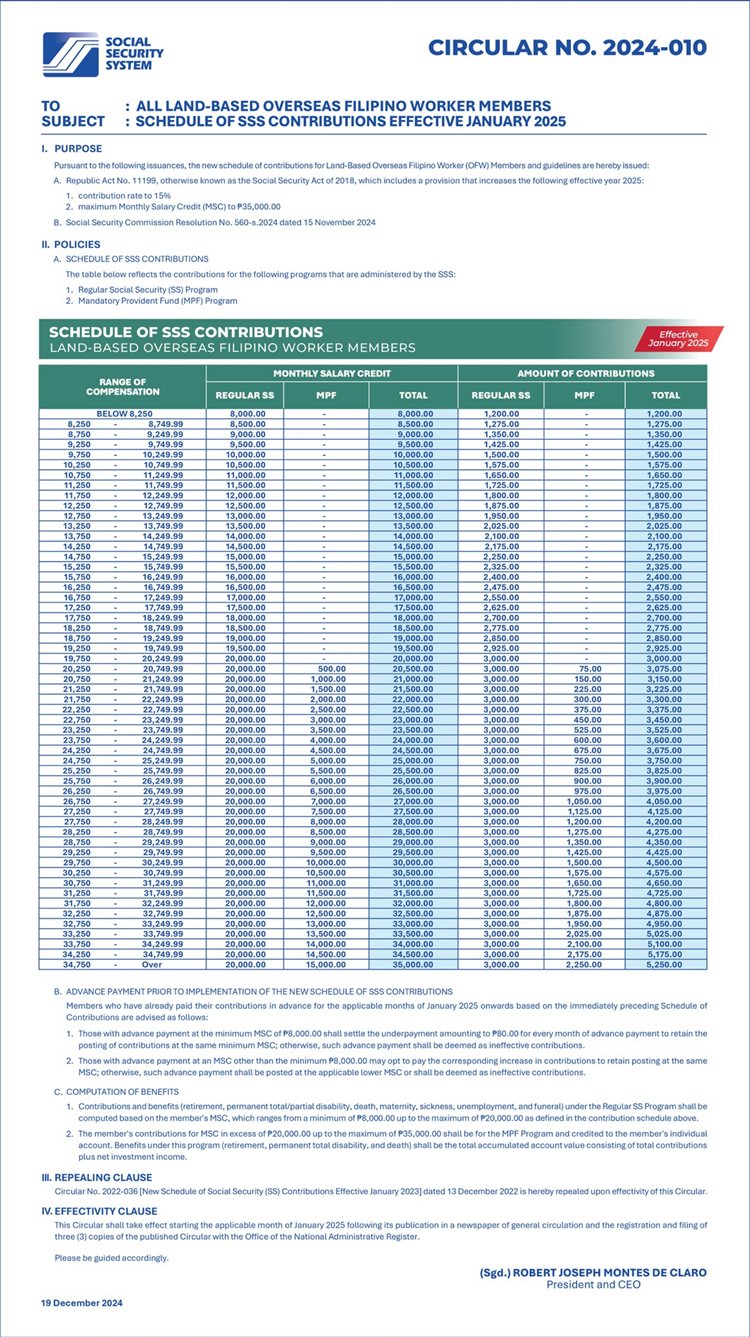

SSS Contribution Schedule Table 2025 for Overseas Filipino Workers OFWs

The SSS contribution schedule for OFWs in 2025 is tailored to ensure that Filipinos working abroad can maintain continuous coverage under the SSS program. Similar to self-employed members, OFWs are required to pay the full 15% contribution.

For instance, at an MSC of ₱10,000, the monthly contribution is ₱1,500, while those who choose the maximum MSC of ₱35,000 contribute ₱5,250. This contribution framework is vital for OFWs to secure benefits such as pensions, disability support, and other essential protections, regardless of their location.

Eligibility Requirements for the New Pension Scheme

To access the enhanced pension benefits, applicants must meet updated eligibility criteria.

General Requirements

- Age: Applicants must be at least 60 years old to qualify.

- Residency: Permanent residency in the Philippines is mandatory.

- Contribution History: A minimum of 120 monthly contributions is required throughout a contributor’s working years.

- Income Status: Beneficiaries should not have active sources of income.

Special Circumstances

- PWDs: Persons with Disabilities can qualify with necessary medical documentation.

- Survivors’ Benefits: Family members of deceased contributors are eligible to claim survivor benefits under this updated framework.

Enhanced Benefits of the 2025 Pension Scheme

The revised scheme introduces multiple improvements designed to benefit contributors and beneficiaries alike.

- Higher Monthly Income: Pensioners can enjoy up to PHP 2,000 in additional monthly income.

- Tax-Free Payouts: The pension remains exempt from taxes, ensuring beneficiaries receive the full amount.

- Inflation-Proofing: Adjustments address inflation, providing retirees with stability even as living costs rise.

- Inclusivity Measures: Self-employed and freelance workers can participate with a contribution as low as PHP 500 per month.

- Sustainability Guarantee: By increasing contribution rates, the SSS ensures that the fund remains viable for generations to come.

Payment Schedule for 2025

To help beneficiaries plan their finances, SSS has released the payment schedule for the year 2025. Pensions will be distributed monthly, with adjustments made to avoid delays due to holidays:

|

Month |

Payment Date |

|---|---|

|

January |

January 31 |

|

February |

February 29 |

|

March |

March 29 |

|

April |

April 20 |

|

May |

May 31 |

|

June |

June 28 |

|

July |

July 31 |

|

August |

August 30 |

|

September |

September 30 |

|

October |

October 31 |

|

November |

November 28 |

|

December |

December 31 |

Beneficiaries are encouraged to mark these dates on their calendars for easier budget management.

Application Process for the Pension Increase

The application process for accessing the updated pension benefits has been designed for simplicity and efficiency.

- Visit the official SSS portal and log in to your account.

- Fill out the pension increase application form with accurate details.

- Upload necessary documentation, such as proof of contributions, valid ID, or medical certificates where applicable.

- Review your application for accuracy and completeness before submission.

- Once approved, the enhanced pension amount will directly reflect in your bank account.

Video: SSS Table 2025 Rates

If you want a guide to the SSS contribution chart table, please refer to this video below which compiles the necessary amount of SSS rates per month according to each member category. This video can help you understand better the new changes this year:

SSS PDF 2025 Increase Download File

If you want to get a copy of the full circular for the 2025 SSS pension increase, you can download the PDF file here. The document contains comprehensive information on all updates to the pension scheme and is available for free. Alternatively, you can view the said PDF file below:

Closing Remarks

The new SSS pension scheme represents an important step forward in supporting Filipinos during their retirement years. By addressing inflation, increasing contributions, and ensuring inclusivity for diverse groups, the government continues its commitment to safeguarding the financial well-being of its citizens. With these systematic improvements, contributors and beneficiaries can look forward to a more secure and comfortable future.